2025 Tax Brackets Married Jointly Over 65. The income tax calculator estimates the refund or potential owed amount on a federal tax return. In 2025, the excess taxable income above which the 28% tax rate applies will likely be $119,550 for married taxpayers filing separate returns and $239,100 for all other non.

2025 federal income tax brackets and rates. In 2025, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1).

Tax Bracket 2025 Married Filing Jointly Over 65 Corri Cassandre, Here you will find federal income tax rates and brackets for tax years 2025, 2026, and 2027.

2025 Tax Brackets Married Jointly Over 65 Carey Maurita, 2025 standard deduction over age 65 there's an additional standard deduction for taxpayers 65 and older and those who are blind.

2025 Tax Brackets Married Jointly Over 65 Carey Maurita, In 2025, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1).

Tax Brackets 2025 Married Jointly Over 65 Doro Electra, 2025 federal income tax brackets and rates.

Tax Brackets 2025 Married Jointly Over 65 Doro Electra, The extra deduction per qualifying spouse will increase from $1,550 in 2025 to $1,600 in 2025, a.

California State Tax Brackets 2025 Married Jointly Flori Leoine, 2025 federal income tax brackets and rates.

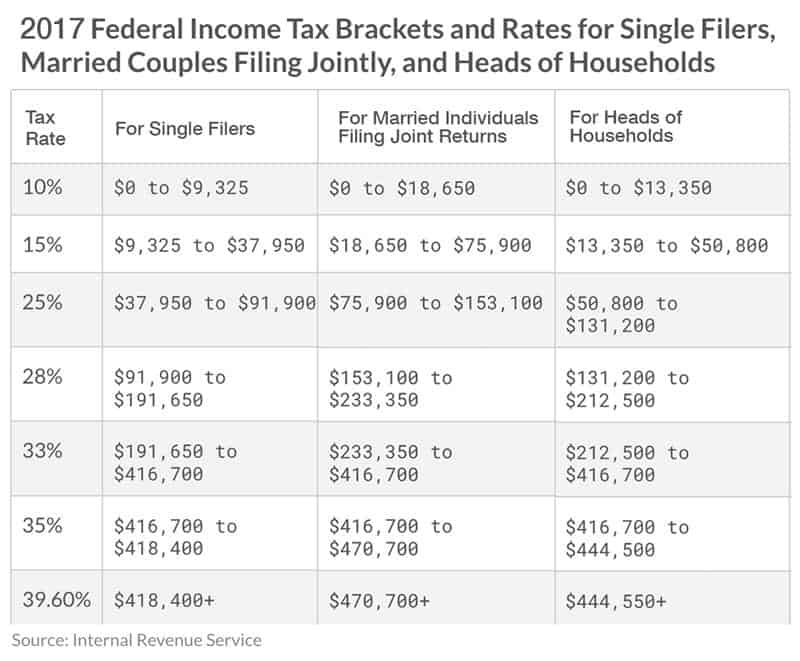

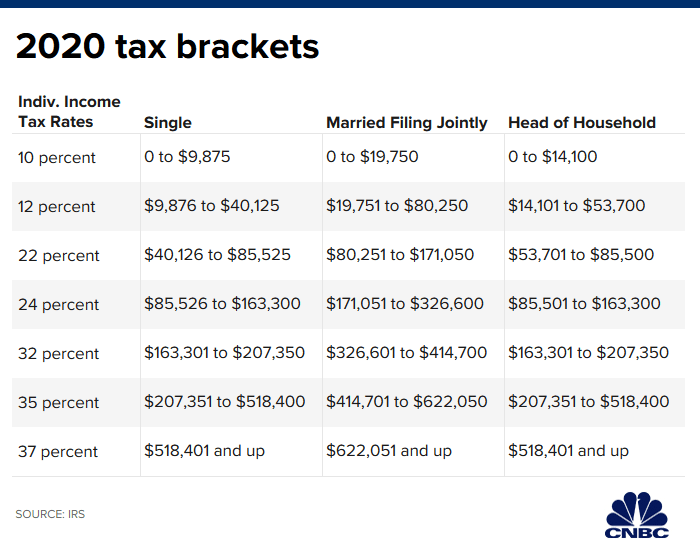

California State Tax Brackets 2025 Married Jointly Flori Leoine, The federal income tax has seven tax rates in 2025:

Tax Brackets For 2025 Filing Jointly Single Amelie Norina, 2025 standard deduction over age 65 there's an additional standard deduction for taxpayers 65 and older and those who are blind.